SBI BPCL Credit Card feature and benefits

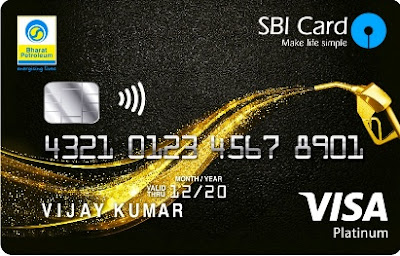

SBI BPCL Card

This is a very popular card for fuel transactions. this card’s annual fee is 499+gst and you spend 50000 in 1 year with this card so you will get reverse the annual fee next year the most SBI customers use this BPCL SBI credit card because this is the most popular SBI credit card for fuel transactions.

Sbi BPCL Credit Card Welcome offers

If you apply for this BPCL card so you will get a 2000 bonus reward point value of 500 rupees. This 2000 reward point you will get on payment of joining fees on joining All SBI BPCL cardholders will get this 2000 reward point. Cardholders get this point within 20 days from payment of joining fee 499+gst. so this is good for the new customers.

Sbi BPCL Credit Card Reward points

You get 13x Reward Points on 100 rupees spent on BPCL Fuel. Maximum points per billing cycle 1300

You get 5x reward point 100 rupees spend on grocery, dining, departmental store, the movie spends Maximum points per billing cycle up to 5000 points

And all other transaction you get 1 reward point on 100 spend

4 reward point value 1 rupee

And after getting rewards point you need 1000 reward to convert into a voucher

In Sbi BPCL credit card if you want to convert your reward point into a voucher, to convert your reward point voucher you need login SBI card application go reward point section to convert your point in voucher you get 250 rupees BPCL voucher if you have 1000 reward point or another way to call customer care

Sbi BPCL Credit Card Fuel surcharge

If you do the transaction on BPCL fuel up to 4000 rupees so you get a 3.25 % + 1 % fuel surcharge

Sbi BPCL Credit Card Annual Fees

Sbi BPCL card annual fees are 499+gst and if you spend 50,000 rupees the previous year so you will get back your annual fees next statement.

Sbi BPCL credit card finance charges

If you pay your mad (minimum amount due) so less than your TAD (total amount due) or if you did not pay any amount so you charge finance charges on this card finance charges 3.5% plus GST per month and these charges applicable on your outstanding

Sbi BPCL card late fee charges

If you paid your MAD(minimum amount due) so you will not charge any late fees charges, but you not paid your MAD so you will charge late fee charges on this BPCL card, if you paid MAD so you charge only finance charges.

Late fee charges on the amount

Its depend on TAD (total amount due)

500 to 1000 = 400+ gst

1000 to 10000 = 750 + gst

10000 to 25000 = 950 + gst

25000 to 50000 = 1100 + gst

50000 or greater than 50000 you will charge 1300 + gst

BPCL card over-limit fees

BPCL Credit card over-limit fees 600 + GST or 2.5% + GST whichever is higher if you over-limit this card so you will charge these fees

BPCL Sbi card ATM fees

If you withdraw cash from ATM with this BPCL Sbi Card so you will charge 500 + GST this charge still applicable all ATM transaction

Sbi BPCL Credit Card offers

This BPCL card provides you many offers like Encash loan and balance transfer, Flexipay EMI, easy money draught and many marketing offers, if you want any loan or EMI so you need to use SBI card application or other options call customer care

How To Apply for BPCL Card

if you want to apply for this card go to www.sbicard.com and apply for this card other option you applied for this card by the Sbi Card sales agent. Sbi Card has two types of BPCL Card with different benefits or features another Card name BPCL Octane Card

Hello friends my name DK Jaswal and this is my website am from Delhi, India, and this website about social media stuff, finance and credit cards This website helps you know about finance and credit card benefits, charges, fees